.png)

- Est. Market Value - property value as determined by the County Assessor to be what the property would most likely sell for on the open market.

- Homestead Market Value Exclusion – Applies to residential homesteads and to the house, garage, and one acre of land on agricultural homesteads. The exclusion is a maximum of $30,400 at $76,000 of market value, and then decreases by nine percent for value over $76,000. The exclusion phases out for properties valued at $413,800 or more.

- Taxable Market Value – property value for the tax year reduced by applicable limitations, exclusions, exemptions and deferrals.

- Property Class – the statutory property classification that has been assigned to your property based on its use.

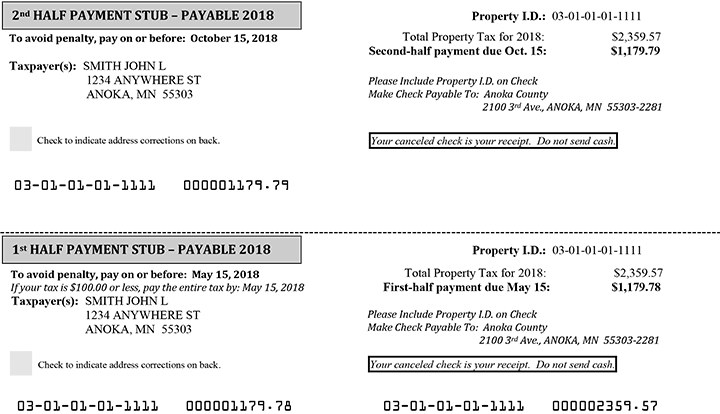

- PIN – property identification number.

- M-1PR – The State of Minnesota provides two types of property tax refunds. For more information, go to the Minnesota Department of Revenue Web site.

- Other Credits – This line includes the Agricultural Preserve credit and the School Building Bond Credit. The Agricultural Preserve credit is applied to qualifying metropolitan properties in long-term agricultural use. The School Building Bond Credit is applied to all property classified as 2a (agricultural land), 2b (rural vacant land), and 2c (managed forest land), excluding the house, garage, and surrounding 1 acre of land of an agricultural homestead. The credit is 40% of the tax on the property attributable to school district-bonded debt levies.

- County/Municipal Public Safety System – an ad valorem tax first imposed in 2003 to improve technology County-wide in order to enhance public safety.

- Voter Approved Levies – levies resulting from referenda passed in specific taxing districts.

- Other Local Levies – levies resulting from budgeting requirements in specific taxing districts.

- Other Special Taxing Districts – Includes Housing and Redevelopment Authorities (HRA), Port Authorities, hospital districts and water management districts. Not all areas have each of these districts.

- Special Assessments – charges to benefiting property owners for city/township provided improvements such as road paving, sewer installation, etc.

- Solid Waste Management Charge – A charge levied against all improved properties in the county, revenues from which are used to protect our public health, land, air and water through waste-to-energy conversion, extensive recycling efforts, household hazardous waste collection, yard waste composting, public information and waste reduction.

- Contamination Tax – a tax placed on parcels where the State has determined the ground is contaminated, revenues from which are used for decontamination.

- Proposed Property Tax – this amount does not include any special assessments.