|

|

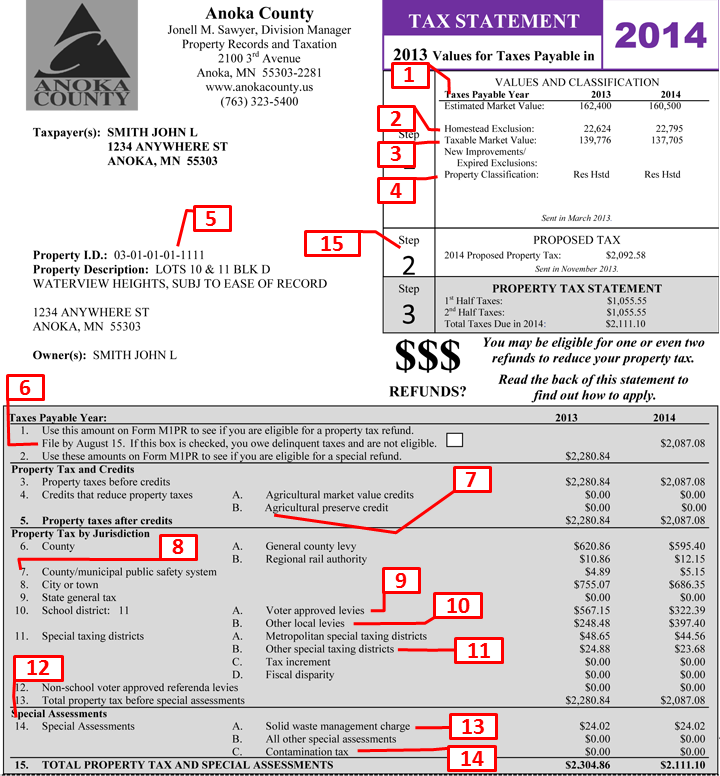

- Est. Market Value - property value

as determined by the County Assessor to be what the property would

most likely sell for on the open market.

- Homestead Market Value Exclusion –

Applies to residential homesteads and to the house, garage, and one

acre of land on agricultural homesteads. The exclusion is a maximum

of $30,400 at $76,000 of market value, and then decreases by nine

percent for value over $76,000. The exclusion phases out for

properties valued at $413,800 or more.

- Taxable Market Value – property

value for the tax year reduced by applicable limitations,

exclusions, exemptions

and deferrals.

- Property Class – the statutory

property classification that has been assigned to your property

based on its use.

- PIN – property identification

number.

- M-1PR – The State of Minnesota

provides two types of property tax refunds. For more information, go

to the Minnesota Department of Revenue Web site.

- Agricultural Preserve – credit

applied to metropolitan properties in long-term agricultural use if

qualified for this program.

- County/Municipal Public Safety System

– an ad valorem tax first imposed in 2003 to improve technology

County-wide in order to enhance public safety.

- Voter Approved Levies – levies

resulting from referenda passed in specific taxing districts.

- Other Local Levies – levies

resulting from budgeting requirements in specific taxing districts.

- Other Special Taxing Districts – Includes Housing and Redevelopment Authorities

(HRA), Port Authorities, hospital districts and water

management districts. Not all areas have each of these districts.

- Special Assessments – charges to

benefiting property owners for city/township provided improvements

such as road paving, sewer installation, etc.

- Solid Waste Management Charge – A

charge levied against all improved County properties, revenues from

which are used to protect our public health, land, air and water

through waste-to-energy conversion, extensive recycling efforts,

household hazardous waste collection, yard waste composting, public

information and waste reduction.

- Contamination Tax – a tax placed

on parcels where the State has determined the ground is

contaminated, revenues from which are used for decontamination.

- Proposed Property Tax – this

amount does not include any special assessments.

page last updated -

04/02/2014

|